Arbitrum: Revolutionizing the Ethereum Ecosystem

Arbitrum, also known by the market ticker ARB, is a layer-2 scaling solution for Ethereum, which allows the Ethereum network to manage network traffic, and as a result, helps to keep ETH gas fees to a minimum.

However, being launched only a few months ago, there is a good chance Arbitrum is not currently on your radar. Which begs the question, should it be? Today we find out!

What is Arbitrum?

Arbitrum was created by Offchain Labs back in 2021.

Offchain Labs was founded by Ed Felten, Steven Goldfeder and Harry Kalodner. All are former Princeton University researchers with specialist experience in computer science, cryptography and blockchain technology.

Arbitrum’s blockchain would go live in March 2023.

However, as we mentioned, Arbitrum is a layer-2 scaling solution, which means it is a layer built on top of another blockchain to help with a specific task. In this case, Ethereum.

More specifically, layer-2 scaling solutions are a method used to improve the scalability and efficiency of a blockchain network by performing certain transactions or computations off the main blockchain.

Meaning layer-2 solutions act as independent blockchains, as if they didn’t their data would likely only further congest the network.

By reducing the burden on the main blockchain, layer-2 scaling solutions enable faster and cheaper transactions while enhancing the overall scalability of the base, layer-1 blockchain as a whole.

So, how exactly does Arbitrum work?

How does Arbitrum work?

As Arbitrum is a layer-2 solution built on the Ethereum network, it follows the same consensus mechanism as Ethereum to ensure the information between the networks is instantly transmittable and verifiable by the layer-1.

That makes Arbitrum a Proof-of-Stake blockchain like Ethereum.

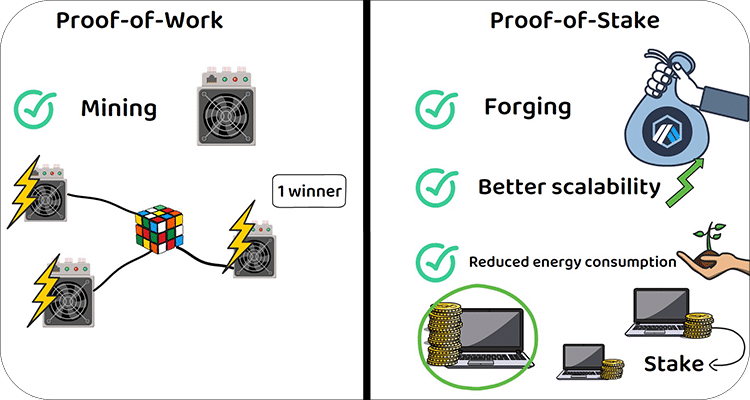

To quickly recap, Proof-of-Stake, unlike its more famous cousin, Proof-of-Work, does away with “mining” for cryptocurrencies and replaces it with forging, which is just the creation of all the crypto tokens before the launch of the blockchain.

While each Proof-of-Stake blockchain differs in how it releases these newly created tokens, the main reason they all do this is for better scalability and reduced energy consumption later.

Instead of making miners compete to solve a complex mathematical equation first, which results in many people spending energy when there will only be one winner, Proof-of-Stake blockchains instead select a participant with a large amount of their crypto deposited to the network, known as the stake, to verify its transactions.

Instead of making half the network verify its legitimacy, which takes more time and costs more energy, Proof-of-Stake blockchains only require a handful of validators to ensure legitimacy.

Of course, no network would put that much trust in so few individuals without a failsafe or two, one of which being the Byzantine fault tolerance.

To keep it short, this is essentially computer code written into the blockchain that allows the blockchain to function accurately even if up to a third of the network is acting dishonestly.

What makes Arbitrum unique?

Arbitrum uses a technique known as Optimistic Rollups, which is one of the methods Arbitrum utilizes to achieve the fastest and smallest possible transfer of data between two parties.

Optimistic Rollups aim to enhance scalability by processing and validating transactions off-chain while still leveraging the security and decentralization of the underlying blockchain.

In an Optimistic Rollup, instead of directly executing and verifying each transaction on the main layer-1 blockchain, a group of validators bundle multiple transactions together and produces a cryptographic proof known as a “fraud proof.”

This proof is submitted to the Layer 1 to confirm the validity of a transaction.

In case of a dispute or fraud, the system relies on the fraud proofs submitted to the Layer 1 to enforce the correct execution of transactions and maintain the integrity of the network.

The optimistic aspect of Optimistic Rollups lies in the assumption that the majority of transactions are honest and do not involve fraud. This approach significantly reduces the computational burden and transaction fees on the main blockchain, as most transactions are processed off-chain.

By employing this approach, Optimistic Rollups achieve high throughput and low costs while still ensuring the security of the network.

Interestingly, the technology from which Optimistic Rollups was created, known as Zero Knowledge Proofs, was first conceived by the future Algorand founder back in 1985.

Moving on, as we know, projects live and die by their tokenomics, so how does ARB compare?

ARB Tokenomics

ARB is fixed at a supply of 10 billion, which was pre-mined as is customary for Proof-of-Stake networks.

The 10 billion was divided between the Arbitrum DAO, which took over 42%, the team at Offchain Labs and other advisors received just under 27%, 17.5% went to investors, and around 11.5% was airdropped to users, with the remaining % being airdropped to other DAOs.

ARB’s main utility comes in paying for transactions on their blockchain. However, unlike many Proof-of-Stake blockchains that say their token is being used to pay for transactions, ARB is actually utilised by the Ethereum blockchain to process their off-chain transaction requests.

Like most other Proof-of-Stake coins, holders can stake their ARB for additional rewards, and holders can also use ARB to participate in the governance of the protocol.

Governance proposals could include upgrades to the platform, changes to network parameters, allocation of DAO funds, grants and bounties, or the integration of new features.

However, unlike many Proof-of-Stake tokens that aim to artificially induce scarcity to increase their token prices, Arbitrum doesn’t require you to pay for Arbitrum fees in ARB.

Instead, fees can be paid in ETH or any other accepted ERC-20 token.

This allows users to continue using Arbitrum services without giving up their ARB holdings, which could still be staked to earn additional rewards on top.

In conclusion, Arbitrum is an exciting project, as it’s already in use by Ethereum users.

A few months back, Arbitrum took the spot as the largest scaling solution on the Ethereum network, which is impressive given the size of Ethereum and the recent release of ARB.

Clearly Arbitrum has found itself a use case and a fan base among Ethereum users.

Does this guarantee anything over the long run? Of course not, but it does suggest that as long as Ethereum needs to be scaled off-chain, Arbitrum will have a use case.